Car insurance is one of the most essential things every American driver needs — not just to stay legal, but to stay protected financially. Whether you drive a new Tesla or a 10-year-old Honda, the right insurance plan can save you from paying thousands after an accident. Let’s break down everything you need to know to get the best car insurance deal in the USA this year.

Top Car Insurance Companies in the USA

Here are some of the best-rated car insurance companies based on customer satisfaction, affordability, and coverage options:

- GEICO – Best for low rates and digital experience.

- State Farm – Best for customer service and claims support.

- Progressive – Best for custom coverage and safe driver discounts.

- Allstate – Offers high-end plans and accident forgiveness.

- Liberty Mutual – Great for bundle savings (home + auto).

Each of these companies lets you get free quotes online, compare coverage, and even adjust plans to match your driving habits.

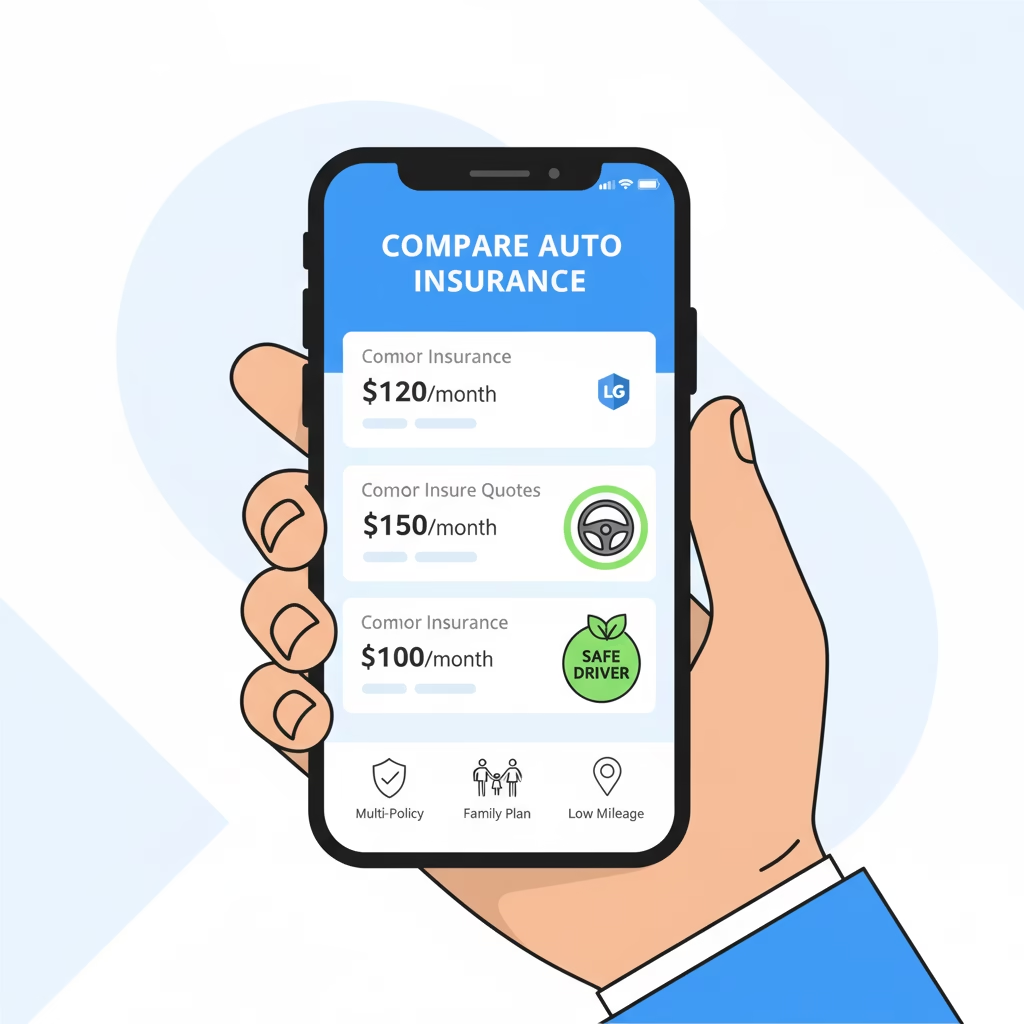

How to Get the Best Auto Insurance Quote Online

Follow these steps to grab the best deal:

- Visit comparison websites like GEICO, Progressive, or NerdWallet.

- Enter your info – ZIP code, car make, model, and driving history.

- Select coverage – Choose between liability or full coverage.

- Compare offers – Focus on value, not just price.

- Buy instantly online once you find the right plan.

Most insurers give instant quotes — no phone calls or agents needed.

How to Save Money on Car Insurance

Want to lower your monthly insurance bill? Try these proven tips:

- Compare Quotes Regularly: Don’t stick with one insurer. Rates change every 6 months.

- Maintain a Clean Driving Record: Fewer violations = lower premiums.

- Bundle Policies: Combine car + home insurance for up to 25% savings.

- Raise Your Deductible: Higher deductibles can reduce your premium.

- Use Telematics: Some insurers offer discounts if you drive safely using mobile apps or smart devices.

Even small changes can save you hundreds of dollars a year.

Understanding Car Insurance Coverage

Before buying a policy, make sure you know what’s included:

- Liability Coverage: Covers damages to other people and property.

- Collision Coverage: Pays for damage to your car after an accident.

- Comprehensive Coverage: Protects against theft, vandalism, and natural disasters.

- Uninsured Motorist Coverage: Helps if the other driver doesn’t have insurance.

Most experts recommend having full coverage, especially if your car is newer or financed.

Car Insurance Rates by State

Car insurance prices vary a lot depending on where you live. For example:

- Florida and Michigan usually have the highest premiums.

- North Carolina, Maine, and Ohio offer some of the lowest rates.

Location, age, driving history, and vehicle type all play a role in your insurance cost.

Online Tools to Compare Car Insurance

Don’t waste time calling every company. You can use sites like:

These platforms show real-time quotes from top insurers and help you switch policies online within minutes.

FAQs About Car Insurance in the USA

Q1: Is car insurance mandatory in every U.S. state?

Yes, almost every state requires at least basic liability coverage to drive legally.

Q2: What’s the average cost of car insurance in the USA?

The average driver pays around $1,700 per year, but this depends on your state, vehicle, and credit score.

Q3: Can I switch insurance anytime?

Yes, you can cancel or switch insurance at any time — just make sure your new policy starts before the old one ends.

Q4: What’s the best way to find cheap car insurance?

Compare quotes online and check for discounts like good driver, student, or bundle offers.

Final Thoughts

Choosing the right car insurance in the USA doesn’t have to be confusing. Compare rates, understand your coverage, and look for discounts that fit your lifestyle. With the right plan, you’ll save money and stay protected wherever the road takes you.

Read More About: Best Auto Insurance Quote in 2025 – Save Money on Your Car Coverage

1 thought on “Best Car Insurance in the USA – Compare Rates & Save Big”

Comments are closed.