If you own a car in the United States, you already know auto insurance isn’t optional — it’s the law. But when shopping for a policy, one question always pops up:

“Should I go with basic auto insurance or full coverage?”

The truth is, both have their place. What’s “better” really depends on your car, your budget, and your comfort with risk. Let’s break it down so you can make a confident, smart decision.

What Is Basic Auto Insurance?

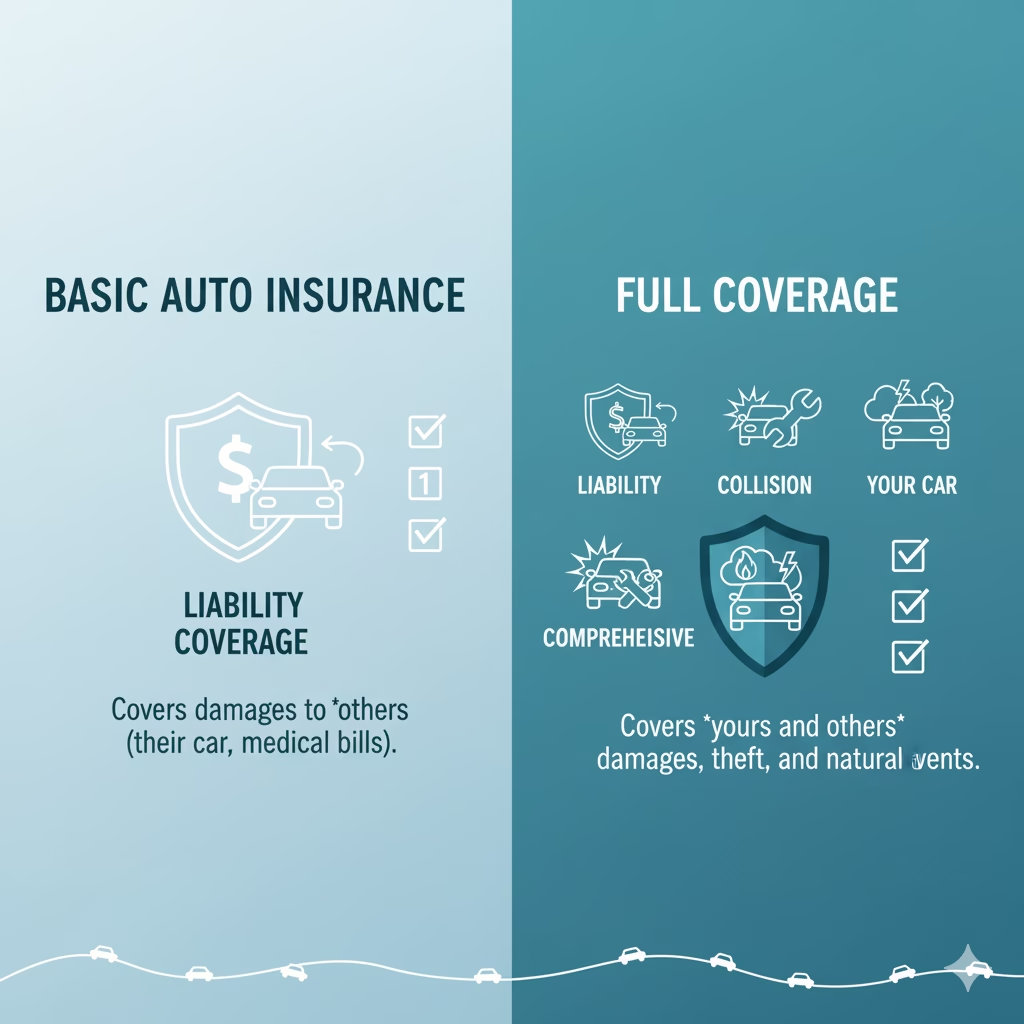

Basic auto insurance (often called liability insurance) covers damages you cause to others — their vehicle, property, or medical bills — when you’re at fault in an accident.

In most states, this type of insurance is required by law, and it includes two major parts:

- Bodily Injury Liability (BIL) – covers the other driver’s injuries.

- Property Damage Liability (PDL) – covers the other driver’s vehicle or property.

However, it does not pay for your own car repairs or injuries. So if your car gets hit or stolen, basic auto insurance won’t help.

What Does Full Coverage Include?

“Full coverage” isn’t a specific policy. It’s a combination of coverages that protect you and your vehicle, not just others. Typically, it includes:

- Collision Coverage – pays for your car’s repairs after an accident, even if you’re at fault.

- Comprehensive Coverage – protects against theft, fire, vandalism, natural disasters, or hitting a deer.

- Liability Coverage – still included, as required by law.

Full coverage is the go-to choice for people with newer or high-value cars, or those financing or leasing their vehicle. Lenders usually require it.

Read More: Commercial Auto Insurance in the USA – Full Coverage for Your Business Vehicles

Price Comparison: Which One Costs More?

Here’s the truth — full coverage costs more, sometimes 2 to 3 times the price of basic auto insurance.

According to Bankrate’s 2025 Auto Insurance Report, the average cost of full coverage in the U.S. is about $1,850 annually — nearly triple the cost of basic liability insurance.

But paying extra often means saving thousands later if something goes wrong — especially for new or luxury vehicles.

When Basic Insurance Is Enough

Basic coverage is fine if:

- You drive an older car that’s worth less than $4,000–$5,000.

- You don’t drive much or mostly park in a safe area.

- You’re comfortable taking the financial risk for your own vehicle.

In short, if replacing your car wouldn’t break your budget — basic coverage makes sense.

When Full Coverage Is Worth It

Choose full coverage if:

- Your car is new, financed, or leased.

- You live in a region with heavy traffic, theft, or bad weather.

- You want total peace of mind — knowing your car is protected no matter what happens.

Think of full coverage as a safety net that prevents unexpected financial headaches.

Which Is Better Overall?

There’s no one-size-fits-all answer.

If you’re budget-conscious with an older ride — basic auto insurance works.

If you care about complete protection and peace of mind, full coverage is the smarter play.

In reality, most Americans choose a blend — liability coverage plus a few optional add-ons (like roadside assistance or rental car reimbursement) for the best balance of cost and protection.

Key Takeaway

Your choice should match your car’s value, your driving habits, and your financial comfort zone. The best policy isn’t always the cheapest — it’s the one that protects you when life takes a wrong turn.

FAQ Section

Q1: Is full coverage required by law in the U.S.?

No, only liability coverage is required by law. Full coverage is optional but often required by lenders for financed cars.

Q2: Does full coverage cover theft?

Yes. Comprehensive coverage (part of full coverage) pays for theft, fire, vandalism, and weather damage.

Q3: Can I switch from full coverage to basic anytime?

Absolutely. You can adjust or downgrade your policy whenever you want — just make sure your state’s minimum requirements are met.

Q4: Is full coverage worth it for older cars?

Usually not. Once your car’s value drops below $4,000–$5,000, it’s often smarter to stick with basic coverage.