Hey there, Louisiana drivers! From navigating the bustling streets of New Orleans during Mardi Gras to cruising the bayous in Baton Rouge or handling rural roads in Shreveport, your car is key to life in the Pelican State. But let’s face it—Louisiana’s car insurance rates are notoriously high, thanks to frequent hurricanes, high litigation, and accident-prone highways. If you’re hunting for cheap quotes, you’re not alone; with 2025 bringing some rate relief from reforms and lower accident frequencies, now’s a great time to shop smart. In this guide, we’ll focus on finding affordable options, breaking down averages, factors driving costs, top budget-friendly providers, proven savings tips, and the latest trends. Whether you’re a budget-conscious family in Lafayette or a first-time driver in Lake Charles, you’ll get the tools to slash your premiums without skimping on coverage. Let’s dive in and save some dough!

Louisiana’s Average (and Cheap) Rates

Louisiana ranks among the priciest states for car insurance, but cheap quotes are out there if you know where to look. As of November 2025, the average full coverage policy costs around $3,626 per year, or about $302 monthly, according to World Population Review. For minimum coverage—which meets Louisiana’s requirements of 15/30/25 liability ($15,000 per person/$30,000 per accident for bodily injury, $25,000 for property damage)—expect about $1,200 annually, or $100 monthly. These are well above the national average of $2,149 for full coverage, due to high claim rates and natural disaster risks.

Data varies by source: MoneyGeek pegs full coverage at $2,832 yearly ($236 monthly) and minimum at $1,188 ($99 monthly), while Experian reports $2,726 annually ($227 monthly). Insure.com estimates a steeper $4,180 per year ($348 monthly) for full. 8 Bankrate notes rates 53% above national, with New Orleans at $5,948 yearly vs. Sulphur’s $3,817. For a 40-year-old with a clean record and good credit, cheap full coverage might start at $197 monthly, but add a teen or accident, and it could double.

Location spikes costs—urban areas like NOLA see 20-30% higher premiums from traffic and theft, while rural spots offer relief. Rates dipped slightly in 2025 (average 2.3% decrease), thanks to fewer accidents, but they’re still up 55% since 2020 nationally. The good news? Providers like Southern Farm Bureau offer full coverage as low as $197/mo.

Why So High, and Factors Influencing Cheap Quotes in LA

Louisiana’s rates are inflated by high bodily injury claims (three times national average) and double the losses, per TSL Insurance. Other culprits: Frequent hurricanes, litigation-friendly laws, and a high uninsured rate (adding underinsured motorist costs). 22 19 Your driving record is crucial—a speeding ticket hikes rates 20-30%, an accident 40%, and a DUI could double or triple them for 3-5 years.

Age and gender: Teens pay 2-3x more; young males face extras. Credit score: Poor credit (below 650) adds 30-50%. Vehicle: Luxury or EVs cost more for repairs; safe models save. Location: High-crime or flood zones bump premiums 15-25%. Mileage and usage: High commuters pay more; low-mileage qualifies for discounts. 18 Marital status, education, and occupation subtly help—married or degreed folks often get breaks. 2025 reforms like updated “No Pay, No Play” (limiting uninsured recoveries) aim to curb costs.

Top Cheap Providers for Louisiana in 2025

Budget hunters, rejoice—several standouts offer cheap quotes. USAA tops U.S. News at $2,296/year, ideal for military. Southern Farm Bureau leads The Zebra for full coverage at $197/mo. State Farm shines on MoneyGeek for young drivers and accidents; GEICO for low-income.

Bankrate highlights Geico, USAA, and State Farm as cheapest overall. For minimum: Farm Bureau, Geico, Progressive, USAA, SafeAuto via MarketWatch. WalletHub rates The General, Direct Auto, Louisiana Farm Bureau high. NerdWallet includes GEICO, Progressive, State Farm nationally, applicable here. Compare.com notes State Farm at $64/mo avg. Check J.D. Power for service in the South.

Pro Tips for Scoring Cheap Quotes in 2025/26

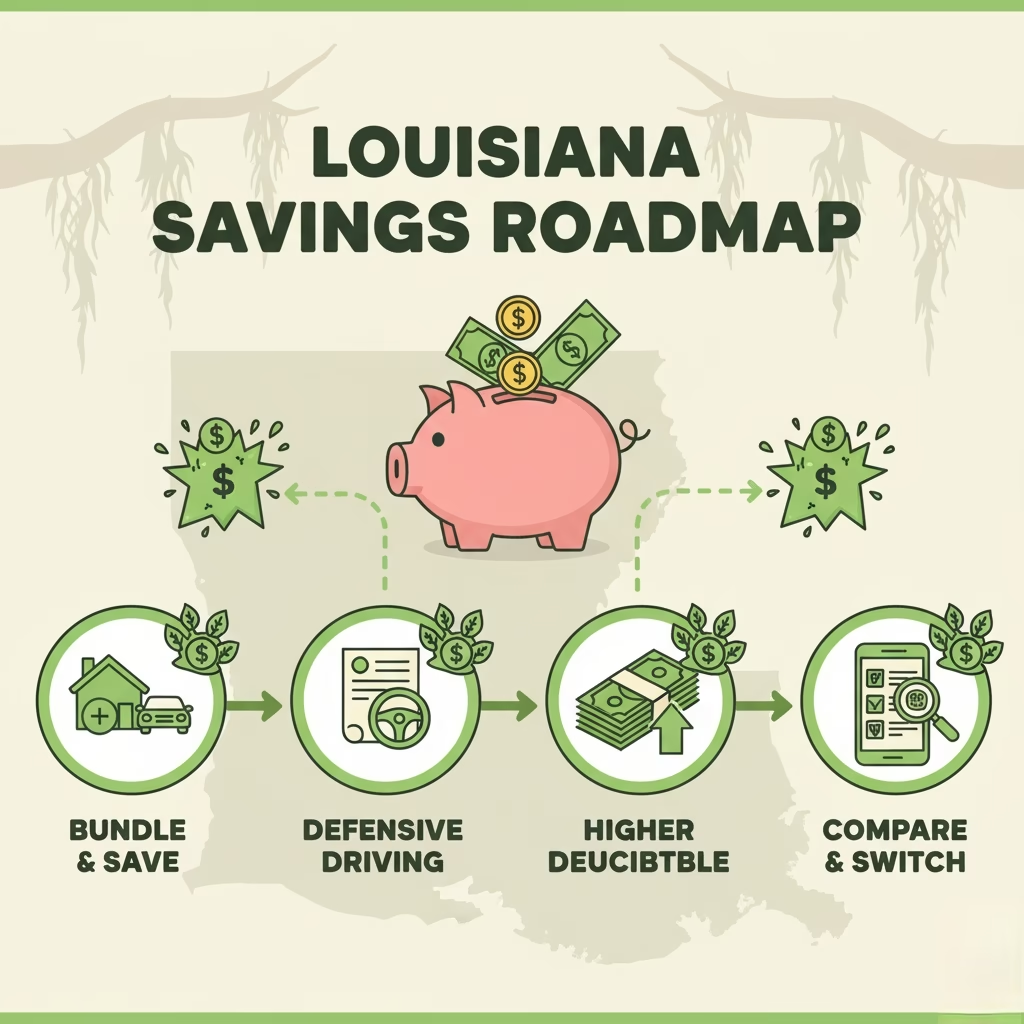

Cutting costs is doable. Increase your deductible to $1,000+ for 10-20% savings, per Consumer Reports and MoneyGeek. Bundle with home/renters for up to 25% off. Take a defensive driving course for 5-10% discounts—Louisiana-approved and quick.

Shop around annually—comparisons save 15-30%, via Liberty Mutual. Consider pay-per-mile if under 10,000 miles/year, like Insurify suggests. Maintain clean record/good credit; drop collision on older cars. Leverage 2025 reforms like higher No Pay No Play thresholds to indirectly lower rates. Pay in full, add safety features, and avoid lapses.

Latest 2025 Trends in Louisiana Car Insurance

Positive shifts: Rates decreased 2.3% avg through July, with 20+ insurers filing reductions due to fewer accidents, per LDI. 23 26 Reforms via Gov. Landry: Updated No Pay No Play raises uninsured limits, aiming to cut fraud/claims. U.S. News notes USAA/Progressive leading amid softening hikes. 24 EVs/telematics rising, but tariffs may nudge up; overall, 2.2% increase in 2024 down from 15.3% in 2023.

How to Get Cheap Quotes Right Now

Use Bankrate or MoneyGeek for comparisons. Input accurate info, contact agents, and review add-ons.

Bottom Line: Cheap LA Insurance Awaits

Finding cheap car insurance quotes in Louisiana is possible with diligence. With averages at $3,626 for full and these strategies, you can drive affordably. Stay updated, compare often, and enjoy the bayou safely.

Read More: Ultimate Guide to Car Insurance Quotes in Oregon – Latest Updates

1 thought on “Finding Cheap Car Insurance Quotes in Louisiana – Tips and Rates”

Comments are closed.