Hey there, insurance seekers! If you’re on the hunt for reliable car insurance that won’t break the bank, Erie Insurance often pops up as a solid contender—especially if you live in one of its 12 service states (Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, or Wisconsin). Known for its customer-first approach and unique perks like Rate Lock, Erie has built a reputation for value and service. But with 2025 bringing rate hikes across the industry, is Erie still worth quoting? In this honest review, we’ll unpack average quotes, coverage details, pros and cons, tips to get the best deal, and the latest market updates. Whether you’re in Pittsburgh or Indianapolis, we’ll help you decide if Erie fits your driving needs. Let’s rev up and explore!

Average Quotes and Costs with Erie in 2025

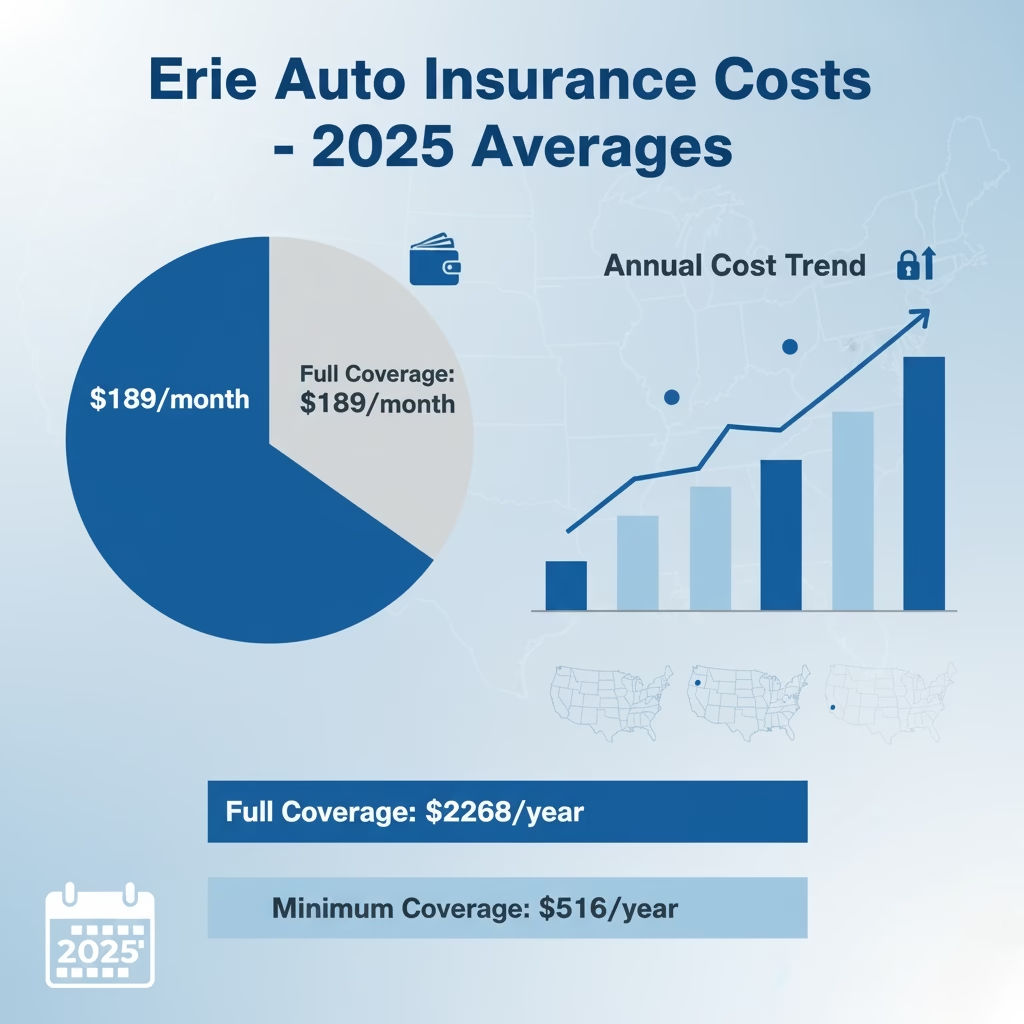

Pricing is where Erie shines, but let’s get real—rates aren’t one-size-fits-all. As of November 2025, Erie’s average full coverage car insurance costs about $189 per month ($2,268 annually), according to Bankrate’s analysis.For minimum coverage, it’s around $43 monthly ($516 yearly), making it one of the more affordable options out there. MoneyGeek ranks Erie ninth for full coverage affordability at $101 monthly ($1,212 yearly) and 11th for minimum at $42 monthly ($504 yearly). The Wall Street Journal’s Buy Side pegs full coverage at $193 monthly ($2,316 yearly) for good drivers.

These figures beat the national average of $2,149 for full coverage, but expect variations by state and profile. For instance, AutoInsurance.com reports minimum at $483 yearly and full at $1,495, with hikes for DUIs ($2,575) or at-fault accidents ($1,884). In Erie, PA specifically, AOL notes averages of $189 for clean records, rising to $202 post-accident or $226 after speeding. Rates have trended up in 2025—some Reddit users report 30% hikes without claims, like from $2,300 to $2,950 annually—due to industry-wide inflation and claims surges. Still, Erie’s competitive edge holds, especially for safe drivers.

Factors like age, credit, and location tweak these. Teens pay more (up to 2-3x), while seniors with clean records get deals. Credit-based pricing in most states means good scores save big. 10 Vehicle type matters too—EVs or luxury cars cost extra for repairs.

Coverage Options and Features

Erie keeps it straightforward but customizable. Core coverages include liability (bodily injury and property damage), collision (for your car’s repairs), and comprehensive (theft, weather, animal hits). Standouts: Uninsured/underinsured motorist, medical payments, and personal injury protection where required.

Unique add-ons make Erie pop:

- ERIE Rate Lock®: Locks your rate even after claims (unless you add/remove vehicles or move)—a lifesaver in a rising market.

- Diminishing Deductible: Reduces your collision/comprehensive deductible by $100 yearly (up to $500) for safe driving.

- Pet Injury Coverage: Up to $500 per pet ($1,000 total) if hurt in a covered accident—great for pet owners.

- Full Window Glass Repair: No deductible for glass fixes.

- Accident Forgiveness: Waives surcharges after your first at-fault accident (after three claim-free years).

- Extras like roadside assistance, rental reimbursement, and locksmith services.

Bundle with home or life for multi-policy savings. Availability varies by state, but overall, it’s robust for families and commuters.

Pros and Cons of Erie Car Insurance

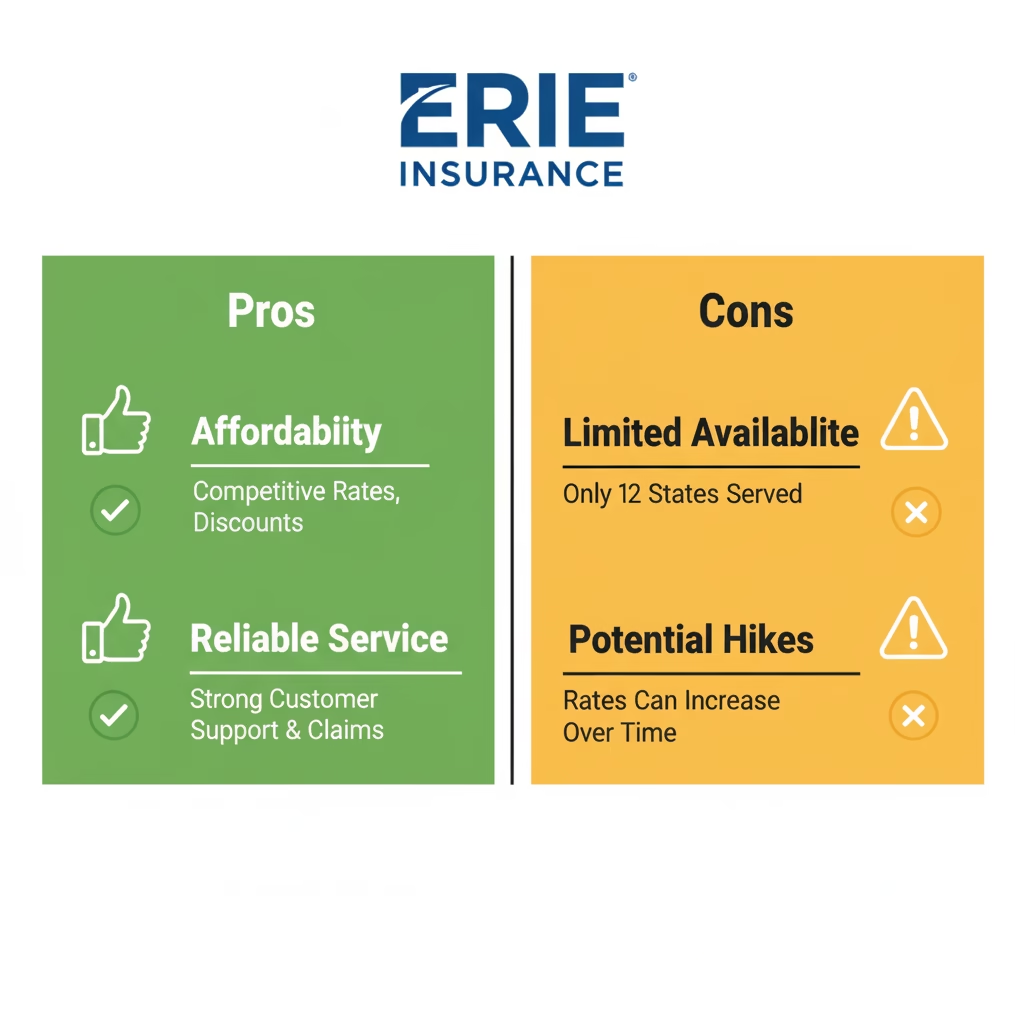

Pros:

- Affordable rates: Often 20-30% below national averages, with strong value for teens and seniors.

- Excellent customer service: High J.D. Power scores (e.g., #1 in shopping satisfaction for 2025) and Bank rate rating.

- Innovative features: Rate Lock and pet coverage stand out.

- Local agents: Personalized help in your community.

- High financial stability: A+ from AM Best and BBB.

Cons:

- Limited availability: Only 12 states—no nationwide coverage.

- Rate hikes: 2025 increases (e.g., 6.4% in Illinois) due to market trends.

- Fewer discounts: Compared to giants like Geico, options are slim (e.g., no telematics program).

- Mixed claims experiences: Some Yelp reviews cite delays or denials, though overall positive (3.2/5 WalletHub).

- No direct online quotes without agent: Must go through locals for some processes.

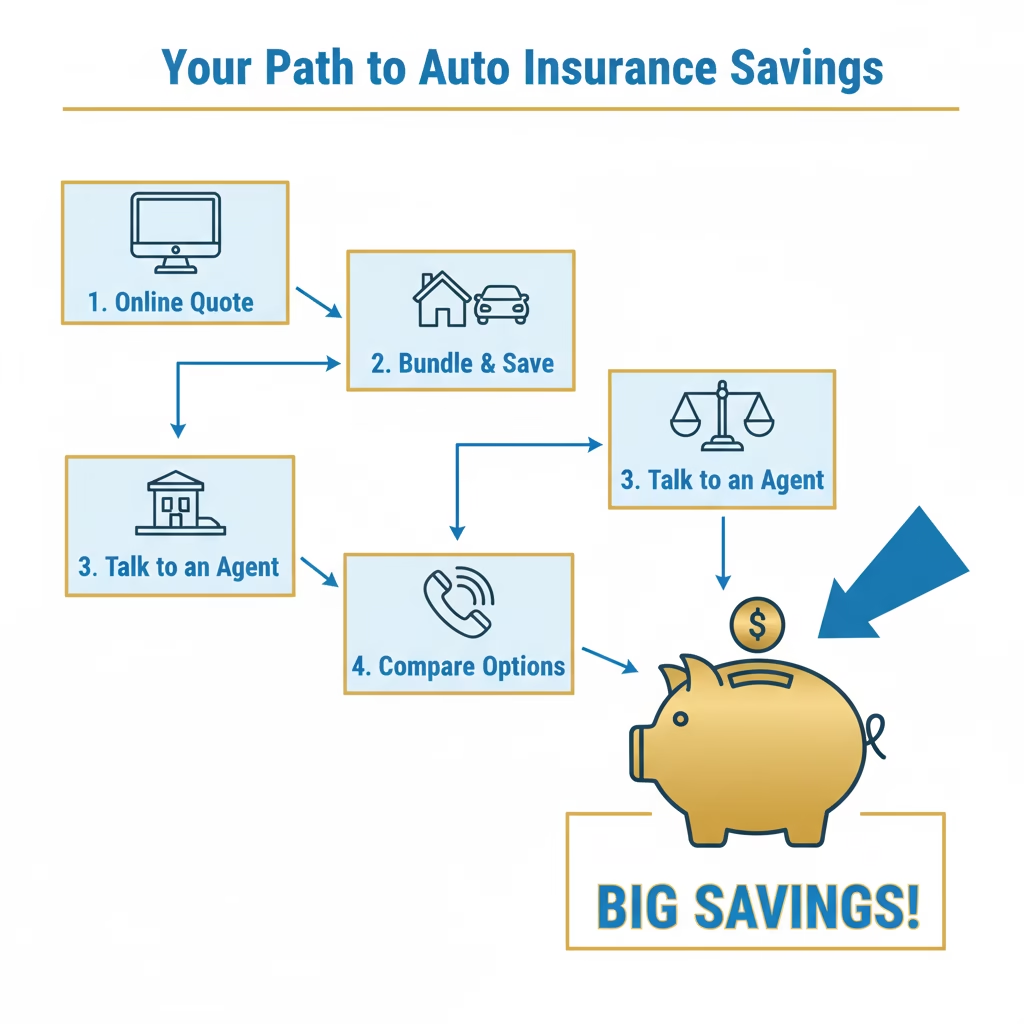

Tips for Getting an Erie Quote

Scoring a great quote is easy but strategic. Start online at ErieInsurance.com for a quick estimate—provide basics like ZIP, vehicle, and driving history. For personalized help, contact a local agent—they’re independent and can tailor policies. Bundle for up to 25% off, add safety features (e.g., anti-theft) for discounts, and shop annually—rates fluctuate. Clean up your credit and record beforehand. Compare with tools like NerdWallet or The Zebra. If high-risk, Erie forgives accidents after time. Avoid surprises by asking about Rate Lock upfront.

Latest Trends and Updates for Erie

The auto insurance market is cooling slightly after 2024’s spikes, but Erie faces headwinds. Q3 2025 earnings show commissions up $41 million YoY, signaling growth amid a $3.5 billion premium market. Rates rose (e.g., 6.4% in IL effective Aug 2025), but J.D. Power ranks Erie #1 in claims satisfaction (down from shopping top spot). Trends: Fewer hikes (37% of customers saw increases vs. higher for others), focus on personalization, and regulatory shifts like Utah’s liability minimums (though not Erie’s area). EVs and tariffs may push costs up, but Erie’s stability (A+ ratings) helps.

How to Get Your Erie Quote Today

Head to ErieInsurance.com or call an agent—quotes take minutes. Provide accurate info for the best rate, and review add-ons.

Verdict: Is Erie Right for You?

If you’re in a covered state and value service over bells-and-whistles, yes—Erie’s affordable, reliable, and customer-focused. With 4/5 ratings across NerdWallet, U.S. News, and ConsumerAffairs, it’s a winner for many. Get a quote and compare.

Read More: Finding Cheap Car Insurance Quotes in Louisiana – 2025/26 Tips and Rates

1 thought on “Erie Car Insurance Quote: Honest Review and Updates”

Comments are closed.