Hey there, Oregon trailblazers! Whether you’re dodging rain showers in Portland, cruising the scenic Columbia River Gorge, or adventuring through the vast forests of the Cascade Mountains, your car is your gateway to the Beaver State’s natural wonders. But with Oregon’s mix of urban congestion, rural roads, and frequent weather-related hazards like floods and wildfires, solid car insurance is essential—not just to meet state requirements, but to safeguard against the unexpected. As we head into late 2025, rates are still climbing due to inflation, higher claims from natural disasters, and increasing repair costs for modern vehicles. Fear not, though—whether you’re a new resident in Eugene or a longtime driver in Salem, this in-depth guide will equip you with all the info on car insurance quotes in Oregon. We’ll explore average costs, key factors, top providers, savings strategies, and emerging market trends. You’ll walk away ready to compare quotes effectively and possibly save big. Let’s hit the pavement!

Breaking Down the Average Cost of Car Insurance in Oregon

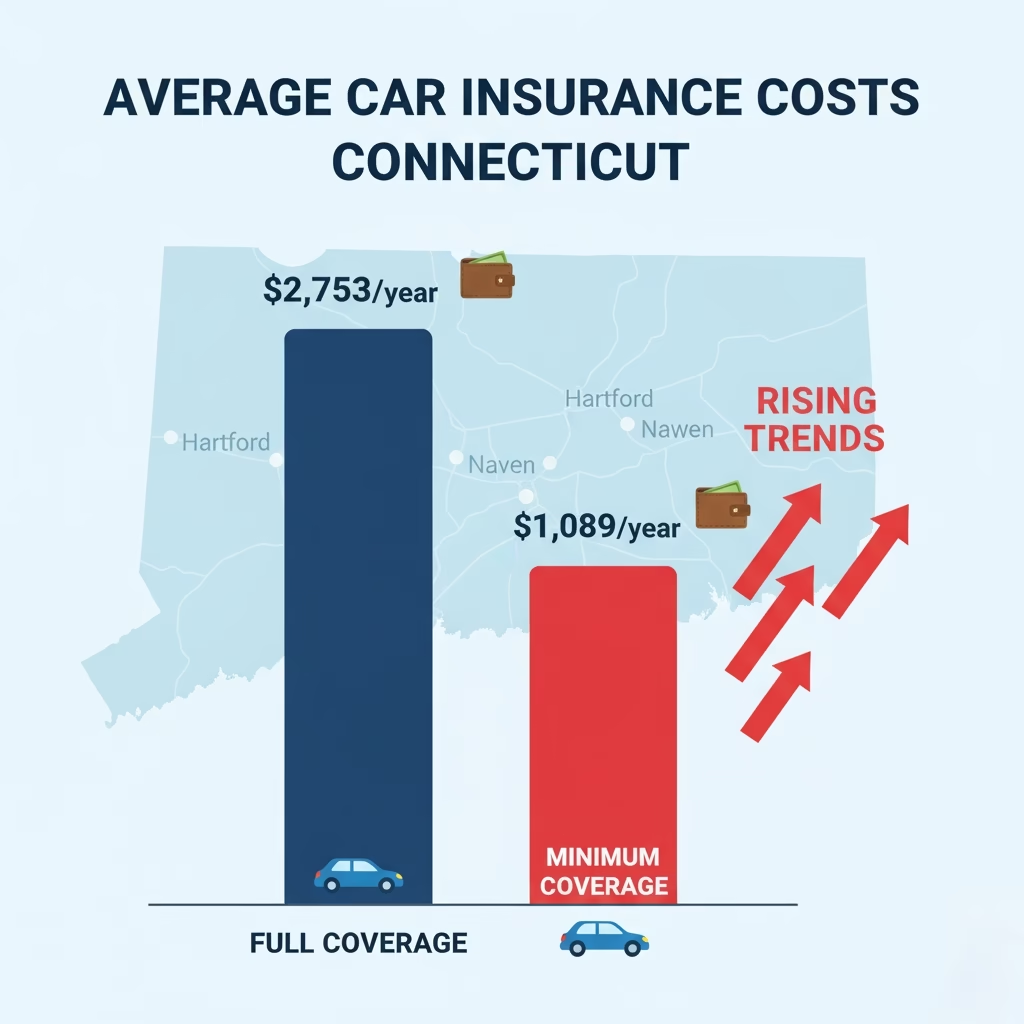

So, what’s the damage to your wallet? As of November 2025, the average full coverage car insurance in Oregon costs about $2,124 per year, or roughly $177 per month, per Bankrate’s latest data. For minimum coverage—which fulfills Oregon’s mandates of 25/50/20 liability ($25,000 per person/$50,000 per accident for bodily injury, $20,000 for property damage), plus $15,000 in personal injury protection (PIP) and uninsured motorist coverage—you’re looking at around $840 annually, or $70 monthly, also from Bankrate. These figures are slightly above the national average of $2,149 for full coverage, reflecting Oregon’s higher minimum requirements and risks like wildlife collisions and stormy weather.

Sources show some variation based on calculation methods. MoneyGeek reports full coverage at $1,380 yearly ($115 monthly) and minimum at $696 ($58 monthly), while Experian hits higher at $2,207 annually ($184 monthly) from September 2025 data. Insure.com estimates $1,927 per year ($161 monthly) for full coverage. 3 U.S. News pegs the state average at $1,743 annually. The differences stem from driver profiles factored in—age, credit, and history all influence. For a 40-year-old with a clean record and good credit, rates might hover around $1,500 full coverage, but adding a teen or an accident could surge it 40-60%.

Location is a major player. Urban spots like Portland face premiums up to 20% higher due to traffic density and theft, while rural areas like Bend see lower costs—Eugene clocks in as the cheapest at $143 monthly, per KTVZ. 40 Rates have risen 10-25% year-over-year, fueled by inflation and more claims, but Oregon remains more affordable than neighbors like California. Some providers offer full coverage as low as $111 monthly, according to NerdWallet.

Key Factors Influencing Your Car Insurance Quote in OR

Quotes are personalized puzzles pieced together from various data points. In Oregon, your driving record is paramount—an at-fault accident boosts rates by about 3-5%, while a DUI can double them for years, as noted by NW Insurance Council. Age and gender matter: Young drivers under 25 pay 2-3 times more due to inexperience, and males often face slightly higher premiums. Credit score? Oregon allows it, so a poor score (below 650) could add 20-50% to your bill.

Vehicle type plays in—insuring an EV or luxury model costs more for parts and repairs, while safer, economical cars save. Location risks, like flood-prone coastal areas or high-crime ZIP codes in Portland, hike premiums via factors such as population density and claim frequency. Broader 2025 elements include inflation-driven medical costs (up 15%), more complex vehicle tech, and annual mileage—high commuters pay extra. Marital status, education, and even occupation subtly affect, with married or highly educated folks often qualifying for lower rates. Oregon’s no-fault PIP system also factors into higher baselines.

Top Car Insurance Providers in Oregon

Choosing wisely can yield big wins. Travelers and Auto-Owners tie for top honors in U.S. News, praised for affordability and service. Progressive leads MoneyGeek’s list for overall value, followed by Travelers, State Farm, GEICO, and Nationwide. USAA excels for military families with low rates, per MarketWatch.

GEICO and State Farm shine for quick quotes and coverage options, with GEICO at $45 monthly minimum via Quote.com. WalletHub highlights The General, Direct Auto, and National General for user ratings. Insurify recommends Root, Dairyland, and Liberty Mutual for specialized needs. Check J.D. Power for regional satisfaction—many score well in the Northwest.

Proven Tips to Lower Your Car Insurance Costs

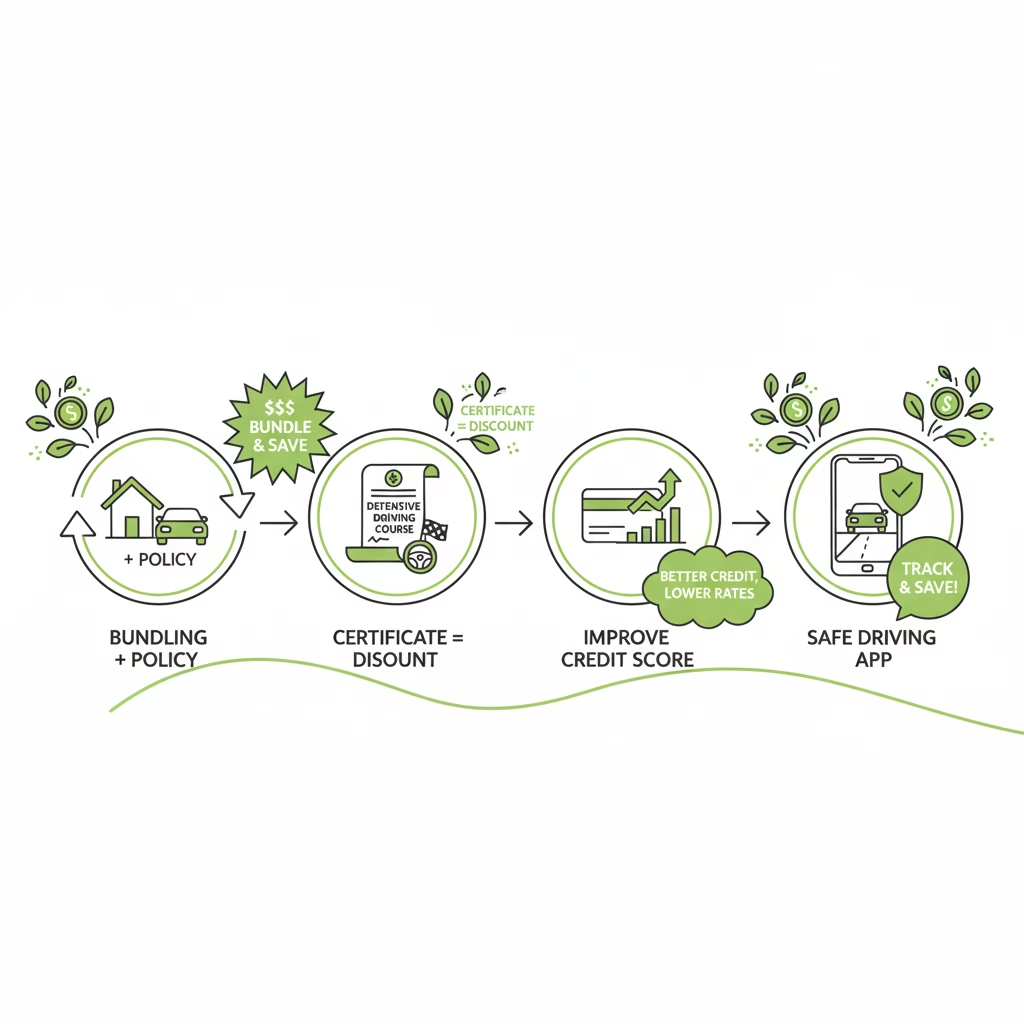

Savings are within reach. Bundle auto with home or renters for up to 25% off, a key strategy from Insurify and Oregon AAA. Raise your deductible to $1,000+ to drop premiums 10-20%. Complete a defensive driving course for 5-10% discounts—Oregon-approved and often online.

Maintain a clean record and good credit—Oregon law allows annual rerates if your score improves, potentially lowering rates without hikes. 25 Opt for pay-per-mile if low-mileage, like Lemonade or Mile Auto programs. Shop around yearly with NerdWallet or The Zebra—comparisons can save 15-30%. 30 Drop unnecessary coverage, pay in full for discounts, and inquire about eco or safety perks for EVs. Avoid lapses, which spike costs 30%.

Latest 2025 Trends Shaping OR Car Insurance

Oregon’s market is shifting. Premiums rose 10-30% in 2025, with tariffs potentially adding more, per The Zebra’s report. Direct premiums hit billions, with a focus on personalization and EVs costing 20-30% more. Bancorp Insurance predicts rising rates from disasters but softening hikes as inflation cools. Telematics and AI quotes are rising, with cheaper cities like Eugene at $143 monthly.

How to Get the Best Quotes Right Now

Use sites like Bankrate or MoneyGeek for instant side-by-sides. Input honest details, consult agents, and scrutinize fine print.

Wrapping It Up: Drive Smart and Save Big

Mastering car insurance quotes in Oregon is achievable with knowledge. With averages at $2,124 for full coverage and these tips, you can secure reliable protection affordably. Stay ahead of trends, compare frequently, and enjoy Oregon’s beauty safely.

Read More : Auto Insurance vs. Full Coverage: What’s Better for U.S. Drivers in 2025?

1 thought on “Ultimate Guide to Car Insurance Quotes in Oregon – Latest Updates”

Comments are closed.